- Adaptive Inclusive

Recreation (A.I.R) - Advisory Boards

- Awards

- Blue Zones Project

- Community Market

- Dogs In Parks Rules

- FAQ's

- Fee Policy

- Friends & Partners

- Master Plan

- Memorial Program

- Mission, Vision, Values

- News Releases

- Park Projects & Planning

- Project Star

- Sea Turtle Protection

- Recycle Information

- Referendum

- Volunteer Opportunities

This is an educational website designed to answer your questions about the Conservation Collier Program and the proposed Referendum on the November 3, 2020 ballot for Collier County residents.

When and how was Conservation Collier originally established?

Conservation Collier was created in 2003, after a November 2002 voter referendum in which voters approved creating a taxpayer-funded conservation land acquisition program. To pay for the program, taxpayers agreed to a property tax increase of up to .25 mills for up to ten (10) years and bonding for up to $75 million. Between 2004 and 2013, the property tax was collected.

What did Conservation Collier do with the funds that were collected from 2004 – 2013?

Funds were used to acquire and manage 4,345 acres of preserve land in 21 different locations throughout Collier County and to open 13 of those preserves to the public. Approximately 20% of the taxes collected were put into a fund for management of existing preserve lands in perpetuity so that no additional tax collections would be required for the management of these existing preserves.

Where are existing Conservation Collier preserves located?

The majority of Conservation Collier preserves are located where people live in the Urban area, Golden Gate Estates, the Rural Fringe Mixed Use District, and Immokalee. Click here for table of preserve locations.

Some of the most visited Conservation Collier preserve land is within the Gordon River Greenway and Freedom Park. The largest preserve is Pepper Ranch Preserve in Immokalee at 2,512 acres.

| Taxable Property Value | Annual Tax Impact |

| 100,000 | $25 |

| 200,000 | $50 |

| 300,000 | $75 |

| 400,000 | $100 |

| 500,000 | $125 |

| 750,000 | $188 |

| 1,000,000 | $250 |

Tell me about the Conservation Collier Referendum on the Ballot. What is it asking the voters?

The Referendum will ask voters if they would like to reestablish a levy of .25 mil ad valorem tax for ten (10) years to continue to fund the Conservation Collier Program’s acquisition and management of environmentally sensitive lands.

For example, if you own a property with a taxable value of $200,000, your ad valorem tax to fund the program will be $50 annually for 10 years.

The basics of the Referendum:

- An ad valorem millage of 0.25 mills OR $25 per $100,000 of taxable property value

- To be collected for 10 years

Where is the Conservation Collier Question on the Ballot?

The Conservation Collier question is the last question on the ballot. An example of how it will look on the ballot is below.

If the Referendum passes, what does Conservation Collier plan to do with the money?

If the Conservation Collier referendum passes, taxes to fund the program will be collected for a period of 10 years:

If the Conservation Collier referendum passes, taxes to fund the program will be collected for a period of 10 years:

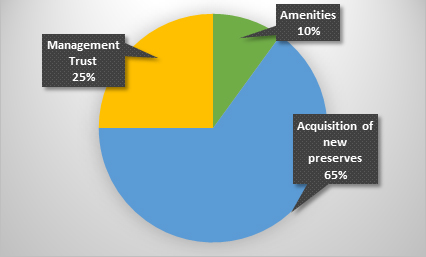

- 65-75% will be used to acquire new preserve land

- up to 10% will be used to fund public amenities at preserves

(may include boardwalks, facilities, parking, interpretive programming, etc.) - 25% will be used for management of acquired preserve lands – A majority of the management funds will be placed in a trust fund that will generate interest for annual management activities so that the program can operate in perpetuity using only the taxes collected over the 10 year period authorized by the referendum.

Section 6.1.e. of the Conservation Collier Ordinance provides that up to seventy-five percent (75%) of all revenues collected for Conservation Collier may be used for acquisition. Section 7.2.a. of the Ordinance provides that management funds shall be no less than twenty-five percent (25%) of revenues collected in one year. If the referendum were to pass, the Conservation Collier Land Acquisition Advisory Committee (CCLAAC) has proposed that up to ten percent (10%) of the acquisition funding be available for use for amenities on an annual basis to improve access to existing and future Conservation Collier preserves. Amenities may include boardwalks, facilities, parking lots, and interpretive staff. This would be evaluated on an annual basis during the Board’s review of the annual budget. This would result in an allocation of a minimum of sixty-five percent (65%) for acquisition, twenty-five percent (25%) for maintenance and a maximum of ten percent (10%) for access improvements.

Voting Information

Conservation Collier, 3300 Santa Barbara Blvd, Naples, FL 34116

239.252.2961